Introduction to the kdj 指标 thinkorswim

What Is the KDJ Indicator?

As a technical analysis tool, the kdj 指标 thinkorswim aids traders in detecting possible market buy and sell signals. The K line, D line, and J line make up the primary part of it, and they all work together to show how the market is moving and what patterns are emerging.

- K Line: Keeps tabs on market movements in the near term.

- D Line: Captures shifts in the middle term.

- J Line: May signal a change in the pricing trend.

Originally created from the stochastic oscillator, the KDJ indicator gives an extra layer of analysis, making it immensely popular among traders.

How Does the KDJ Indicator Work?

The kdj 指标 thinkorswim expands on the stochastic oscillator by adding the J line, which amplifies the signal by indicating the divergence between the K and D lines. This makes it more sensitive to price movements, allowing traders more insights into overbought and oversold market circumstances.

KDJ Indicator on Thinkorswim

Why Use Thinkorswim for KDJ?

Thinkorswim is a strong trading tool with extensive charting features. Its versatility enables traders to build indicators like KDJ to fit their particular trading techniques.

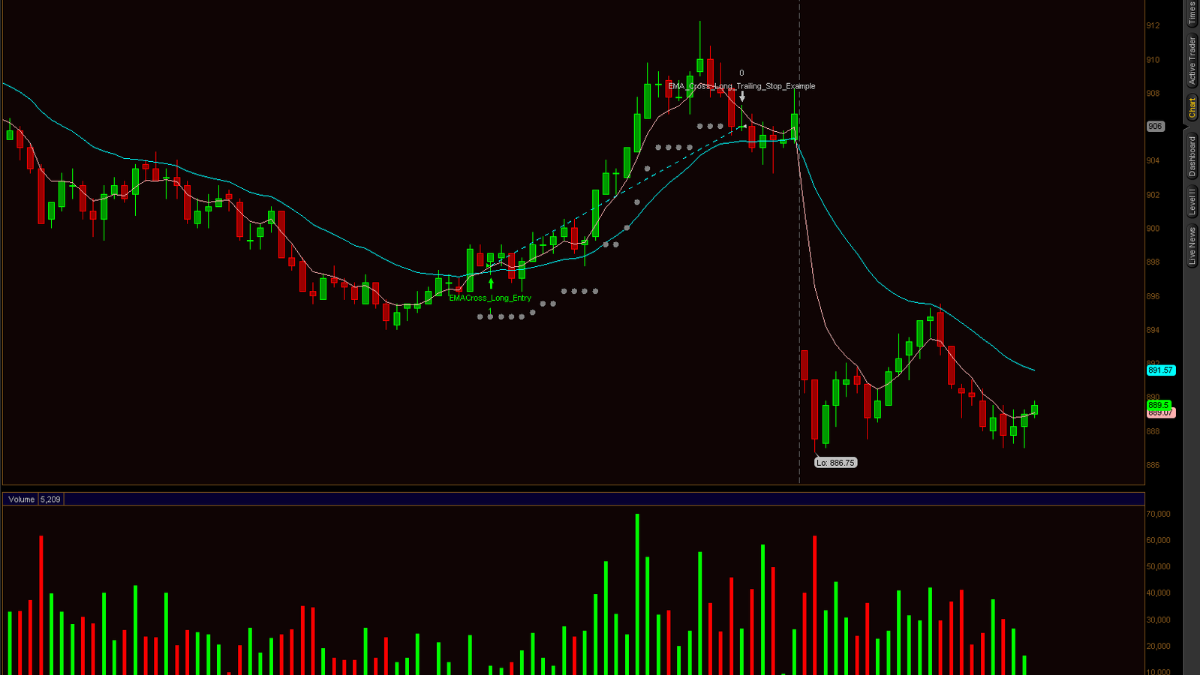

Setting Up the KDJ Indicator

- Open Thinkorswim and proceed to the charting area.

- Click on the “Studies” tab and choose “Edit Studies.”

- Search for “KDJ” in the study library.

- Customize the parameters to match with your approach.

- Click “Apply” to display the indication on your chart.

Decoding the KDJ Indicator

Understanding the K, D, and J Lines

- K Line: Tracks the most recent closing price according to the price range.

- D Line: A moving average of the K line.

- J Line: The divergence of K and D lines, suggesting overbought or oversold circumstances.

Signals Generated by the KDJ Indicator

- Bullish Signal: When the K line crosses over the D line, and the J line rises quickly.

- Bearish Signal: When the K line passes below the D line, and the J line drops.

- Overbought Condition: All lines are around the top threshold.

- Oversold Condition: All lines are around the bottom threshold.

Strategies for Using KDJ on Thinkorswim

Trend Following with KDJ

Use KDJ to find significant patterns. Focus on crossings between the K and D lines to confirm entrance or departure positions.

Combining KDJ with Other Indicators

Pair KDJ with tools like RSI for enhanced confirmation. For example, if RSI indicates overbought circumstances and KDJ displays a bearish crossing, it supports the sell signal.

Advantages and Limitations of KDJ

Benefits of Using KDJ

- Works over several times.

- Provides early signs for trend reversals.

Drawbacks to Consider

- Can provide erroneous indications in stormy markets.

- Requires confirmation from additional indications for dependability.

Conclusion

The KDJ indicator is a powerful tool that, when utilized appropriately, may considerably improve your trading technique. By integrating it into Thinkorswim, you can take use of its sophisticated charting features and make more educated trading choices.

FAQs

- What is the main difference between KDJ and the Stochastic Oscillator?

KDJ incorporates the J line, which offers additional sensitivity to price fluctuations compared to the stochastic oscillator. - Can I use the KDJ indicator for day trading?

Yes, it’s incredibly useful for short-term trading when paired with other indicators. - How do I avoid false signals when using KDJ?

Use confirmation from instruments like RSI or MACD to validate indications. - Is the KDJ indicator suitable for all asset classes?

Yes, but it works best in liquid markets with obvious patterns. - What are the best timeframes for applying the KDJ indicator?

It depends on your approach, but popular periods include 5-minute for day trading and daily for swing trading.